work opportunity tax credit questionnaire on job application

Work opportunity tax credit questionnaire on job application Monday March 7 2022 Edit. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

The application asks for my Social Security Number but I feel uneasy providing it this early in the job application process considering that identity theft is on the rise.

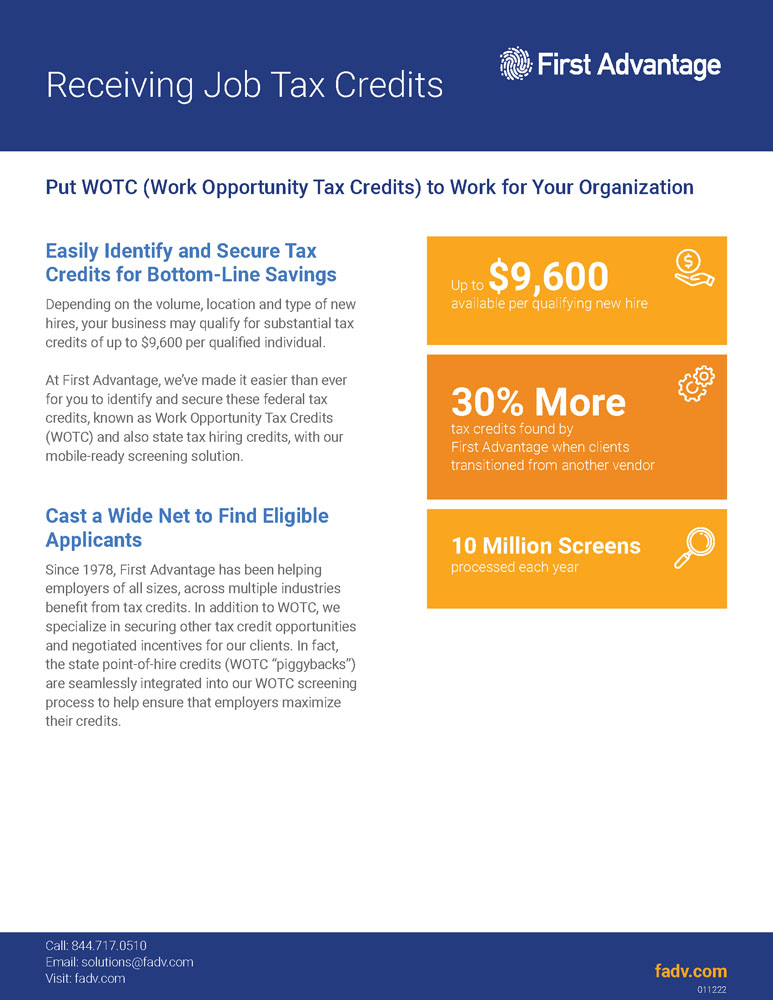

. Is participating in the WOTC program offered by the government. Completing Your WOTC Questionnaire. Through the Work Opportunity Tax Credit WOTC Program employers have the opportunity to earn a federal tax credit between 1200 and 9600 per employee.

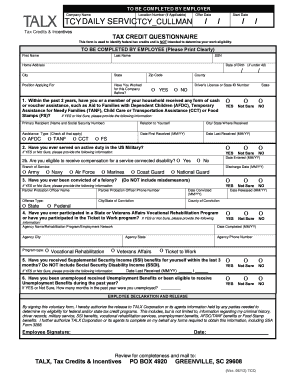

What is the Work Opportunity Tax Credit Questionnaire. Home credit job questionnaire tax. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that.

To provide a federal tax credit of up to 9600 to employers who hire these individuals. Completing Your WOTC Questionnaire. If so you will need to complete the questionnaire when you.

The data is only used if you. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

Employers must apply for and receive a certification verifying the new hire is a. However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. The program has been designed to promote.

The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups. Apply for Work Opportunity Tax Credits You can use the online service eWOTC to. The Work Opportunity Tax Credit is a voluntary program.

The employee groups are. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person.

If so you will need to complete the questionnaire when you. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. Work Opportunity Tax Credit What Is Wotc Adp.

Secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against their payroll taxes. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program.

This tax credit is dependent. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the. A person becomes eligible when they meet the requirements of belonging to one of the target groups of people that.

As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the WOTC eligibility. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that. The WOTC Questionnaire asks questions that are not visible to the hiring managers or hr except admins that control the data flow.

Thats why youll see job fairs targeting veterans or. New hires may be asked to complete the. The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees.

Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a. The employer and the job seeker must complete the Pre-Screening Notice and Certification Request for the Work Opportunity Tax Credits IRS Form 8850 and sign under.

Get And Sign Wotc Questionnaire 2012 2022 Form

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit First Advantage

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit What Is Wotc Adp

With Wotc Timing Is Everything Wotc Planet

Work Opportunity Tax Credit What Is Wotc Adp

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Completing Your Wotc Questionnaire

Completing Your Wotc Questionnaire

Download Simple Application For Employment Form Tidyform Employment Application Job Application Template Employment Form

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credits Wotc Walton

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller